880 W. Long Lake Road • Suite 225 •

Troy, Michigan 48098

• P: 248.269.1122 •

E: bianchipr@bianchipr.com

The state of transparency in corporate sustainability reporting by U.S. companies, who lag behind their European counterparts, leaves big blind spots for investors.

That’s one revelation from the newly published Global ESG Monitor (GEM) – a study of ESG reports from the largest listed companies in Europe, the United States and Australia.

The study was conducted by our Public Relations Global Network partners cometis AG in Germany, Currie Communications in Australia, and Xenophon Strategies in Washington DC, with help from Mileage Communications India and KOHORTEN, a German research institute.

“Corporate ESG reporting shows remarkable differences in quality within and between the regions surveyed. Here, Europeans are often one-eyed kings among the blind,” says Michael Diegelmann, CEO of German investor relations and ESG consultancy cometis.

For the study, a total of 140 companies from the leading indices Dow Jones Industrial Average (USA), DAX (Germany), EUROSTOXX-50 (Europe) and S&P/ASX-50 (Australia) were analyzed.

Both non-financial information in the annual reports (85 integrated non-financial reports – I-NFR) and in official sustainability reports (100 separate non-financial reports – S-NFR) were considered.

The research analysts used a variety of research methods and developed a proprietary analysis method, GEM ASSAY™, which uses data along with quality-evaluation criteria such as comprehensibility, transparency, measurability, comparability, timeliness, adequacy and reliability.

The GEM ASSAY™ consists of 53 general and 490 industry-specific criteria, the latter of which were defined working with the “accounting metrics” of the Sustainability Accounting Standards Board (SASB). Other frameworks, like the Global Reporting Initiative (GRI) and the UN Sustainable Development Goals (SDGs), also informed the study criteria.

Only about a quarter of the reports (27%) provide a methodology and even fewer reports (19%) provide formulas, approaches or calculation methods on how ESG data was gathered. The study also reveals that not even half (41%) of the reports demonstrated transparency when it came to ESG objectives that had not been met.

Ariane Hofstetter, CEO of research institute KOHORTEN, says: “By measuring and comparing sustainability reporting, we want to ensure more transparency. We are convinced that only through transparency can the global sustainability goals be achieved. We could see that the European indexed companies perform better. Is this a coincidence or the result of regulation and political will?”

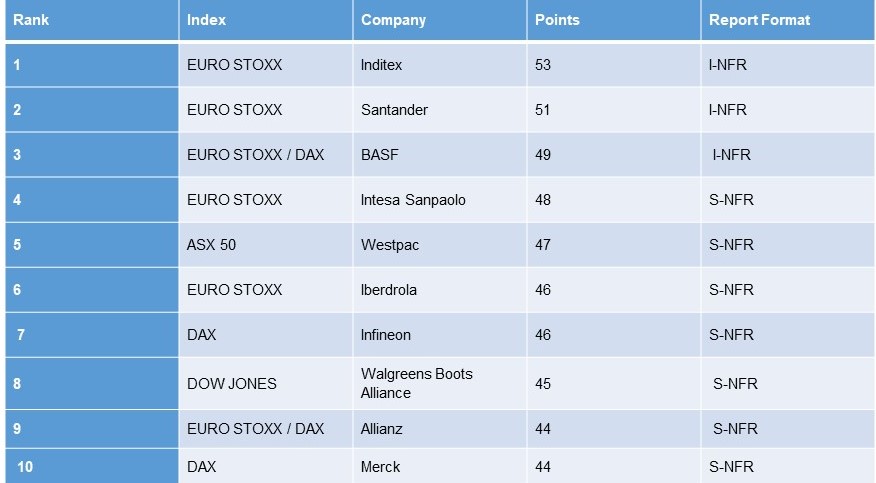

Ranking: European companies dominate, US disappoints

As part of the analysis, indicators were developed to provide a ranking of all reports in the sample. With the maximum score being 66 points, most companies’ reporting was underwhelming with an average GEM reporting score of a mere 26.

Ariane Hofstetter: “Many of the analyzed companies provide ESG data in a variety of formats and make a vast number of references to additional ESG documents, which makes it difficult for even the most experienced ESG analysts to find the relevant information. Some companies communicate on their website, in multiple separate reports or put their information in table-heavy data packs. This is problematic because the information in these unofficial formats can be subject to constant change and make future reviews impossible. This is why we only analyzed the official annual reports and official non-financial reports that are constantly archived.”

Among the Top 10 companies, the three EURO STOXX companies Inditex (53 pts.), Santander (51 pts.) and BASF (49 pts.) displayed ESG information in their integrated annual reports (I-NFR) most convincingly, while EURO STOXX company Intesa Sanpaolo (48 pts.) and ASX-50 member Westpac Banking Corporation (47 pts.) offered the best separate ESG reports.

Only two non-European companies, Westpac (5th rank) and US-American Walgreens Boots Alliance (8th rank), managed to make the Top 10 globally, when looking at both integrated and separate reports:

Of the worst 10 reports, six came from the Dow Jones. Also, the Dow Jones companies delivered the least comparable and transparent information overall among all four indices with an average GEM reporting score of 23 out of a maximum of 66 points.

Says David Fuscus, CEO and President of Xenophon Strategies, a strategic communications firm headquartered in Washington, D.C.: “U.S. companies need to step up their game in ESG reporting. Without transparent reporting, investors and others don’t know how to gauge a corporation’s work on environmental, social and governance issues. Europe does a much better job that the U.S. and it is time for American companies to create greater trust between the private, public and civic sectors.”

Stakeholders still not taken seriously enough

The study highlights the lack of information about stakeholder involvement when it comes to ESG issues.

“Global standards make stakeholder dialogue a priority for sustainability reporting, yet a weakness in reporting common to all regions is transparency around stakeholders,” said Mark Paterson, principal of corporate sustainability specialist Currie. “How stakeholders are identified is not disclosed in four out of five reports. Also, companies are much more likely to report on how issues are being managed rather than naming the issues raised by stakeholders.”

Although over 60% of all reports provide general information on ESG stakeholder dialogue, only 42% disclose details about the company’s approach to stakeholder engagement. Only 18% disclose how companies have responded to ESG issues raised by their stakeholders.

Appropriateness: SASB criteria rarely fulfilled

To find out to what degree companies are disclosing widely accepted financially material information in their ESG reporting, the analysts looked through the lens of the Sustainability Accounting Standards Board (SASB). SASB Standards identify the subset of environmental, social, and governance issues most relevant to financial performance in each of 77 industries defined by SASB’s Sustainable Industry Classification System (SICSTM).

By looking at whether those metrics could be found in the study sample, the researchers aimed to reveal how well companies are already providing the financially material ESG data investors are interested in the most – even if companies had not yet formally implemented the SASB Standards in their reporting.

Overall results show that accounting metrics were partly or fully reported on in 29% of all reports across the four indices, with DAX companies on top with 33% and ASX-50 companies coming in last with 27%.

“Companies are not reporting the appropriate amount of financially material ESG information,” said cometis’ Diegelmann. “This means many companies are struggling to meet a minimum standard of reporting and fail to provide adequate ESG information for the capital markets. It’s disappointing that many reports still appear more like image stories, neglecting the crucial financial side of ESG completely.”

About the Global ESG Monitor

The Global ESG Monitor (GEM) assesses the ESG (environmental, social and governance) transparency of companies around the globe. The GEM is founded on the belief that corporate transparency on ESG is the foundation for solving local, regional, and global sustainability problems and building trust with world leaders.

For this year’s study, ESG reports from companies that are listed on some of the world’s largest stock market indexes were analyzed. The GEM currently scores and ranks 140 companies based on the quality of their separate (S-NFR) or integrated (I-NFR) non-financial reporting. The GEM is an international partnership between cometis and KOHORTEN (Germany), Currie (Australia) and Xenophon Strategies (USA).

The GEM’s analysts use a variety of research methods and a proprietary analysis method, GEM ASSAY™, which uses data along with quality-evaluation criteria such as comprehensibility, transparency, measurability, comparability, timeliness, adequacy and reliability. There are 543 data points. The adequacy of the ESG reports was analyzed using the Sustainability Accounting Standards Board’s (SASB) accounting metrics for non-financial reporting.

Downloadable reports and rankings, as well as other information on GEM, are publicly available at www.GlobalESGMonitor.com.

You might also be interested in: